If you’ve received a late payment on your credit report, you can dispute it. While it’s a simple process, it can be tricky if you were late on the payment in the first place. Nevertheless, it’s worth trying, since creditors sometimes report late payments incorrectly. This process doesn’t cost you anything and can often get the late payment removed from your credit report. Fortunately, this process doesn’t require much time.

Contents

Disputing late payments with the credit bureaus

There are many ways to dispute inaccurate late payments on your credit reports. You should contact the creditor directly or file a dispute with the credit bureaus. However, your best option is to dispute the late payment with the credit bureaus. Creditors typically ignore late payments that are reported in error, so be persistent in your attempts to have the information removed. Check your reports at least once a month and request a refund if you are not satisfied with the information.

When disputing a late payment on your credit report, submit the dispute form and supporting documents with the letter. Make sure you keep track of everything that you send, as well as the date and time of each submission. Use the address for the dispute that is listed on your credit report and send the letter certified mail with a return receipt. If the dispute is not approved, you should contact the Consumer Financial Protection Bureau to register a complaint.

Writing a goodwill letter

When writing a goodwill letter to remove late payments, it’s important to make sure you address the letter to the correct person. Don’t simply copy and paste a letter; the credit specialist has probably already read many goodwill letters and is unlikely to be impressed by your creativity. Your letter should be addressed to the creditor’s correspondence address, which is listed on your credit report.

While writing a goodwill letter, remember not to use an aggressive tone. Although the lender or issuer is not obligated to delete a missed payment, they are obligated to take it off your report. Rather, mention relevant facts about the missed payment and explain why you are sorry. Be direct and concise, as over-explanation will only backfire. Mike Sullivan recommends that you be straightforward, stating only the facts that are relevant to your situation.

Contacting the credit bureaus

If you’ve noticed late payments on your credit report, you may be wondering how you can get them removed. The fact is, late payments can negatively affect your credit score. However, there are several ways to have these negative marks removed from your credit report. If you are unable to make a payment on time, you can contact the credit bureaus and explain your circumstances. In most cases, they’ll remove the late payment if you promise to be more responsible in the future.

The first step is to contact the credit bureaus and dispute the late payment. You can do this through your creditor by filling out a dispute form and sending it in. Be sure to include all of the necessary original documents, such as bills and receipts. If you don’t receive a response from the creditor, you can still try contacting the credit bureaus. The credit bureaus will review your dispute, and the creditor will update your report if necessary.

Checking your credit report for late payments

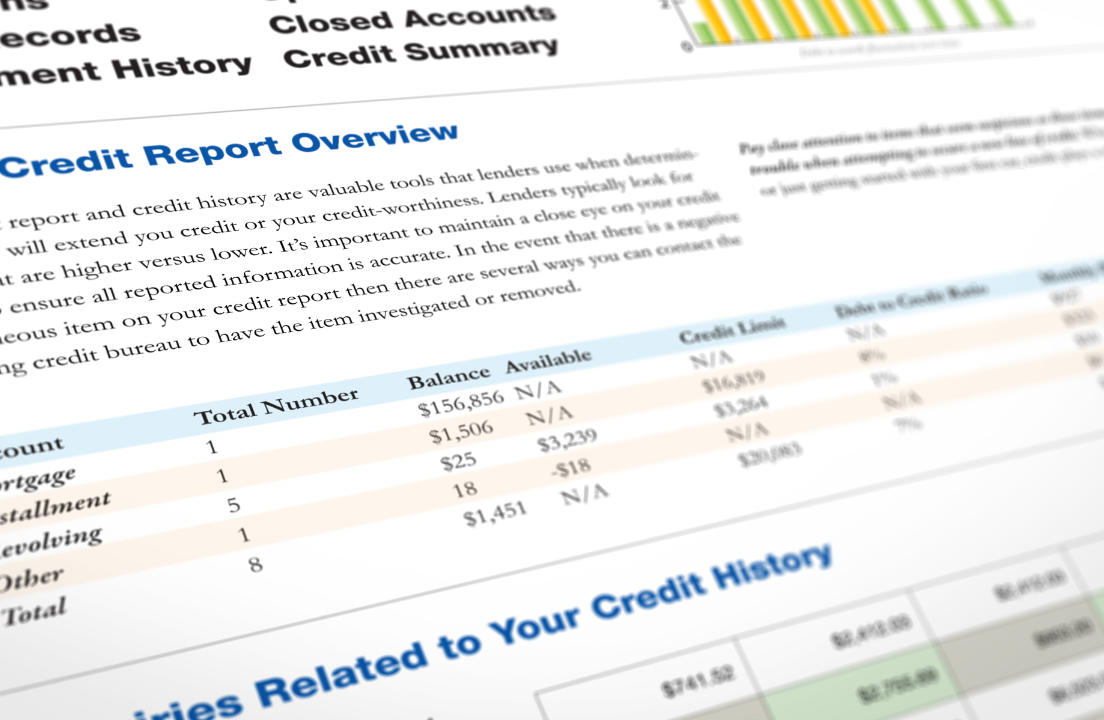

If you’ve missed several payments in a row, you should check your credit report for late payments. Missed payments can ruin your credit history and can even lead to the debt being sent to a collection agency or the creditor closing your account. Late payments are listed under the account for which you’ve been late. They are reported as 30, 60, or 90 days late. There are some steps you can take to dispute these items.

First, you need to know how to dispute an item on your credit report. The three major consumer credit bureaus are Equifax, Experian, and TransUnion. Late payments are often associated with certain types of accounts and may be highlighted differently from on-time payments. A late payment may also be indicated by a different symbol or code, depending on the amount of time you’ve been late. Keep in mind that each credit report is different and you need to check each one to find out which item is late.

Getting them removed from your credit report

Getting late payments removed from your credit report is a good idea. Usually, a late payment will be listed on your report for seven years, though you can ask your lenders to delete it after this time. The good news is that this negative mark will gradually lessen over time, so it’s not too late to start working on improving your credit score. Here are some methods you can try:

The best way to get late payments removed from your credit report is to dispute the late payment with the credit bureau. It is important to dispute the late payment with the credit bureau because they do not want inaccurate information on your report. Make sure to explain your situation and promise to pay more in the future. Also, be sure to keep in mind that you need a positive payment history before you can get late payments removed from your credit report.