Contents1 Before using any of the 10 best cards to build credit, you must first Understand Credit Scores and Why […]

Mon - Fri 10:00-6:00

980-354-1037

Contents1 Before using any of the 10 best cards to build credit, you must first Understand Credit Scores and Why […]

Investing in life insurance is invaluable and safeguards your family’s financial future in the event of your passing. It provides […]

The best homeowners insurance companies are ones that offer the right coverage at an affordable rate. They’re also known for […]

Contents1 Adjustable Rate Mortgages Vs Fixed Rate Mortgages1.1 Adjustable-rate mortgages have a low introductory interest rate1.2 They have caps on […]

The best way to plan for retirement is to start saving as early as possible. When you start saving for […]

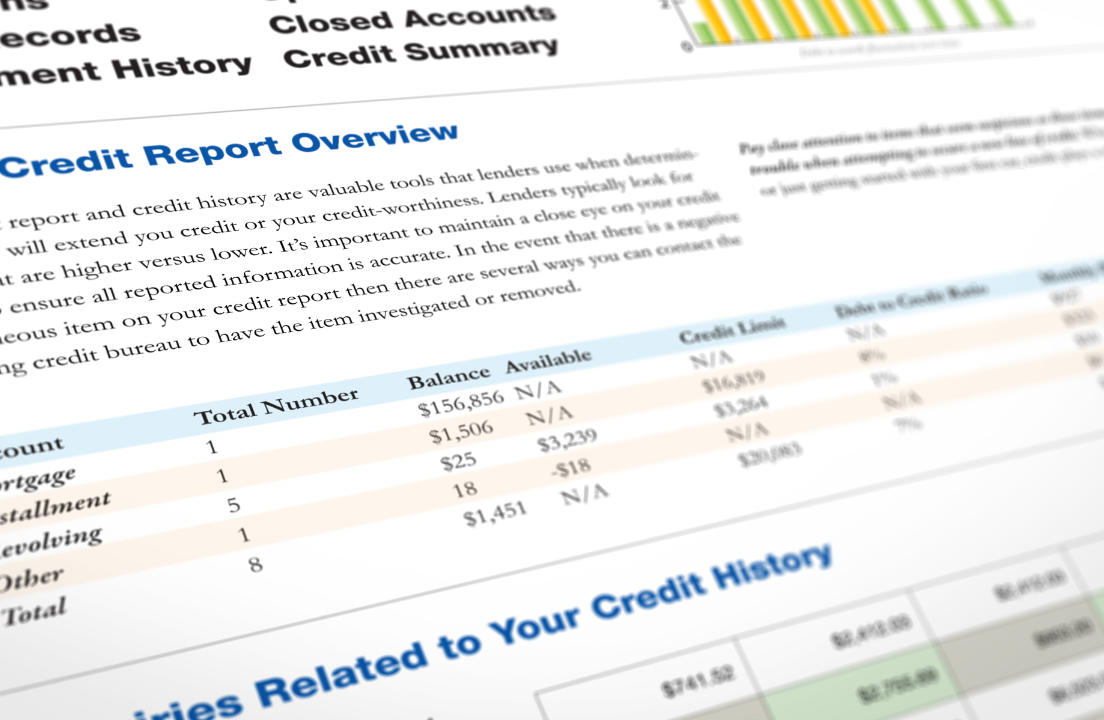

If you’ve received a late payment on your credit report, you can dispute it. While it’s a simple process, it […]

Contents1 1.1 Paying bills on time2 2.1 Adding new types of debt2.2 Getting a co-signer2.3 Using secured credit cards There […]

The importance of Estate Planning cannot be underestimated. Properly drafted wills will ensure that your assets are passed to the […]

Consumer Reports’ annual list of the best and worst credit cards is a must-read for anyone with poor credit. It […]